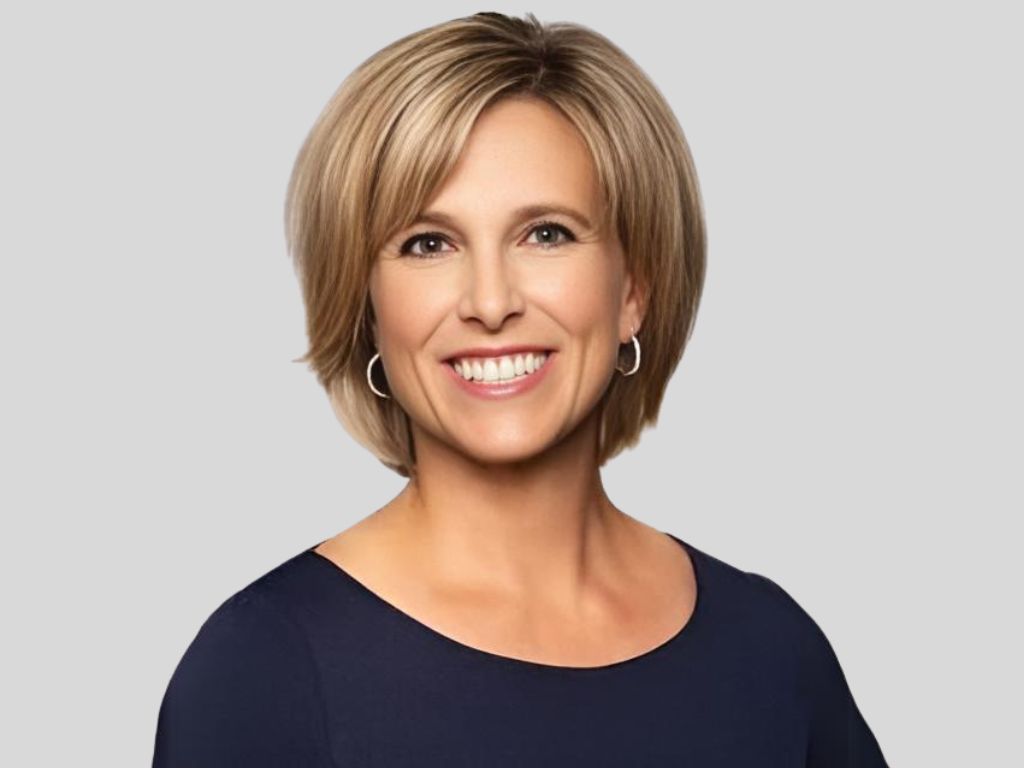

Stephanie Ferris, the CEO of Fidelity National Information Services (FIS), is driving the fintech giant back into the acquisition arena after successfully reducing the company's substantial debt load. Ferris, who took over as CEO amidst significant financial challenges, has announced that FIS is poised to allocate approximately $1 billion annually for acquisitions. The focus will be on smaller, synergistic products that complement FIS's existing offerings.

In February 2024, FIS completed the sale of a majority stake in WorldPay to the private equity firm GTCR, significantly reducing its total debt from $19.1 billion at the end of 2023 to about $10 billion post-sale. As of March 31, 2024, FIS’s debt stood at $11.2 billion with a leverage ratio of approximately 2.7 times. This deleveraging has enabled the Jacksonville-based company to reinstate its mergers and acquisitions (M&A) agenda.

FIS, which provides fintech software to merchants, banks, and capital markets firms, is now targeting acquisitions in areas where it seeks growth, such as digital and payments capabilities within the banking sector and commercial lending technology in capital markets. Ferris emphasized that FIS is not looking to replicate its previous acquihire strategy, as seen with the 2023 purchase of Bond Financial Technologies. Instead, FIS is seeking established businesses with proven revenue and EBITDA, targeting firms with at least $150 million to $200 million in revenue.

The strategic shift comes after FIS reported first-quarter earnings on March 6, 2024, that surpassed expectations, marking the fifth consecutive quarter during Ferris's tenure where FIS has met or exceeded earnings forecasts. This success was highlighted during a triumphant investor day.

Ferris’s leadership has been pivotal in navigating FIS through a period of significant transition. The decision to sell a majority stake in WorldPay reversed one of the biggest payments deals of 2019. This bold move was praised by analysts like Dan Dolev of Mizuho Securities USA, who acknowledged the challenges faced by WorldPay in competing with branded point-of-sale solutions offered by competitors.

FIS continues to be a cornerstone of the financial services industry, powering many major private equity firms and a significant portion of the Forbes 2024 World’s Best Bank list. The importance of FIS's technology was underscored during the regional bank collapses in March 2023, when numerous bank CEOs reached out to Ferris to ensure the continuity of their systems.

Ferris, with her extensive background in finance, including roles as CFO and COO, is now recognized as one of the most influential women in fintech. She regards Jane Fraser, CEO of Citigroup, as a role model, praising her resilience and leadership in the male-dominated financial sector.

Ferris remains committed to driving FIS forward, balancing the company’s growth ambitions with the responsibility of maintaining robust financial services for its clients